Yes, since January 1st, 2012, Aruba introduced a mandatory pension for all employees in the private sector. This means that all employers must have a pension plan for their employees.

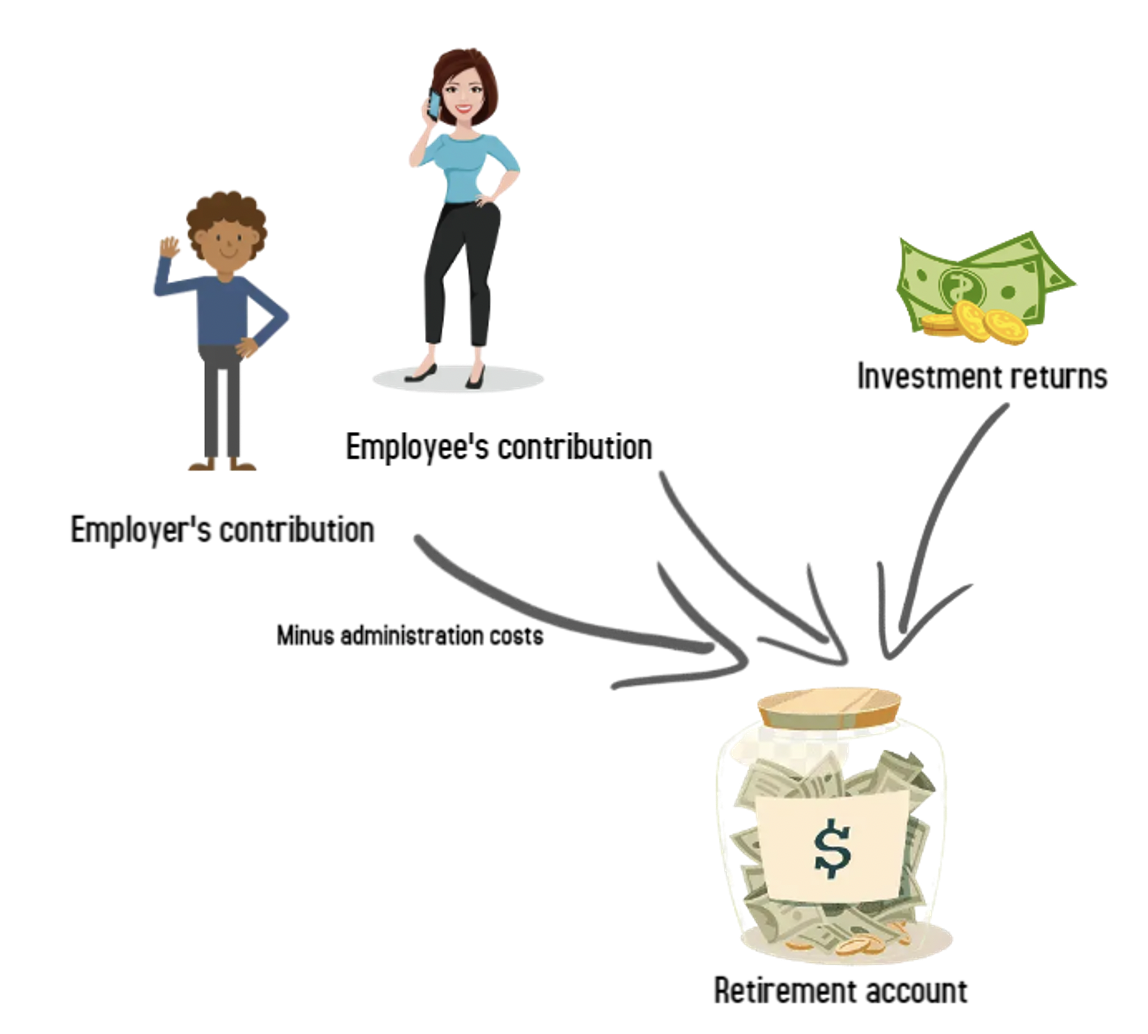

Yes, since January 1st, 2012, pension in Aruba is mandatory. In accordance with the State Ordinance the minimum contribution is 6% of your gross salary, of which the employer must pay at least half. The remainder must be paid by the employee.

In accordance with the State Ordinance the minimum contribution is 6% of your gross salary, increased by any vacation allowance, any points and any fixed bonus and a minimum of 50% of any commission. Overtime will not be considered.

Yes, you can contribute with a higher percentage. The maximum contribution is 25% including the employer’s contribution.

If you have a partner as stipulated in the rules & regulations, your partner will receive a partner pension.

If you have children younger than 21 years or 27 years studying or disabled, they will receive an orphan’s pension.

Otherwise your beneficiaries will receive 70% of the accrued pension capital as a lumpsum. Your beneficiaries are those specified by you on your beneficiary form from Pension Fund Tourism Sector Aruba when you entered employment or upon subsequent amendment. It is important that you always keep this form up to date.

If you change from employer your accrued pension capital will be made vested. You will continue to receive interest annually. And on your retirement date you will receive your pension.

If you have a new employer that is affiliated with Pension Fund Tourism Sector Aruba, you will keep your relationship number, but will start with a new policy. In this case you will have a vested policy from your previous employer and an active policy from your current employer. Both policies will be administrated under the same relationship number.

If you have a new employer that is not affiliated with Pension Fund Tourism Sector Aruba, you can submit a request to transfer your accrued pension capital to your new pension provider or you can keep your policy vested until retirement date.

No, it is not possible to cash out the pension as the law does not allow this. You can only submit a request to cash out the accrued capital in case of emigration, 3 years after you have emigrated.

Your retirement date is equal to the retirement date for the AOV. At this moment the retirement date for everyone born on July 1st, 1959 or later is 65 years. For persons born before July 1st, 1959 it depends on the date you were born.

Yes, you can submit a request to retire later, but not later than at 70 years old.

Yes, you can submit a request to retire earlier, but not earlier than at 60 years old. Please note that you will not yet receive AOV and will therefore be obliged to pay AOV-premium.

Every year you receive a digital personal benefit statement from us which states your accrued pension capital. You can find your personal benefit statement in the online portal.

You can cash out your accumulated pension capital after living three years abroad if you have not reached your retirement date yet.

You can also choose to leave your accrued pension capital vested. You will continue to earn interest annually and on your retirement date you will receive your pension.

If your previous employer was not affiliated with Pension Fund Tourism Sector Aruba, you can request your former pension provider to transfer your accumulated pension capital to Pension Fund Tourism Sector Aruba

You can receive your accumulated pension capital as a lumpsum only if the pension amount that will be paid out is less than Afl. 50.00 per month. All amounts higher than Afl. 50.00 per month, must be paid out monthly.

That is not possible if you work with an employer affiliated with Pension Fund Tourism Sector Aruba.

This depends on several factors such as the capital accrued, the interest and the mortality tables. On your personal benefit statement, you can get an estimation of how much pension you will receive in the future.

If your question has not been answered, please don’t hesitate to contact us at telephone number (297) 582-4499 or by e-mail at info@pftsa.com. It is a pleasure to help u.

Pension Contact Information

Phone: 582-4499

Email: info@pftsa.com

WhatsApp: 592-5613

Company

Information

Forms

Members area

Request more pension information