- Pension plan

- Pension premium contribution

- Flexibility

- Resignation

- Death

- Emigration

- Online Portal

- Personal Benefit Statement

Pension contribution

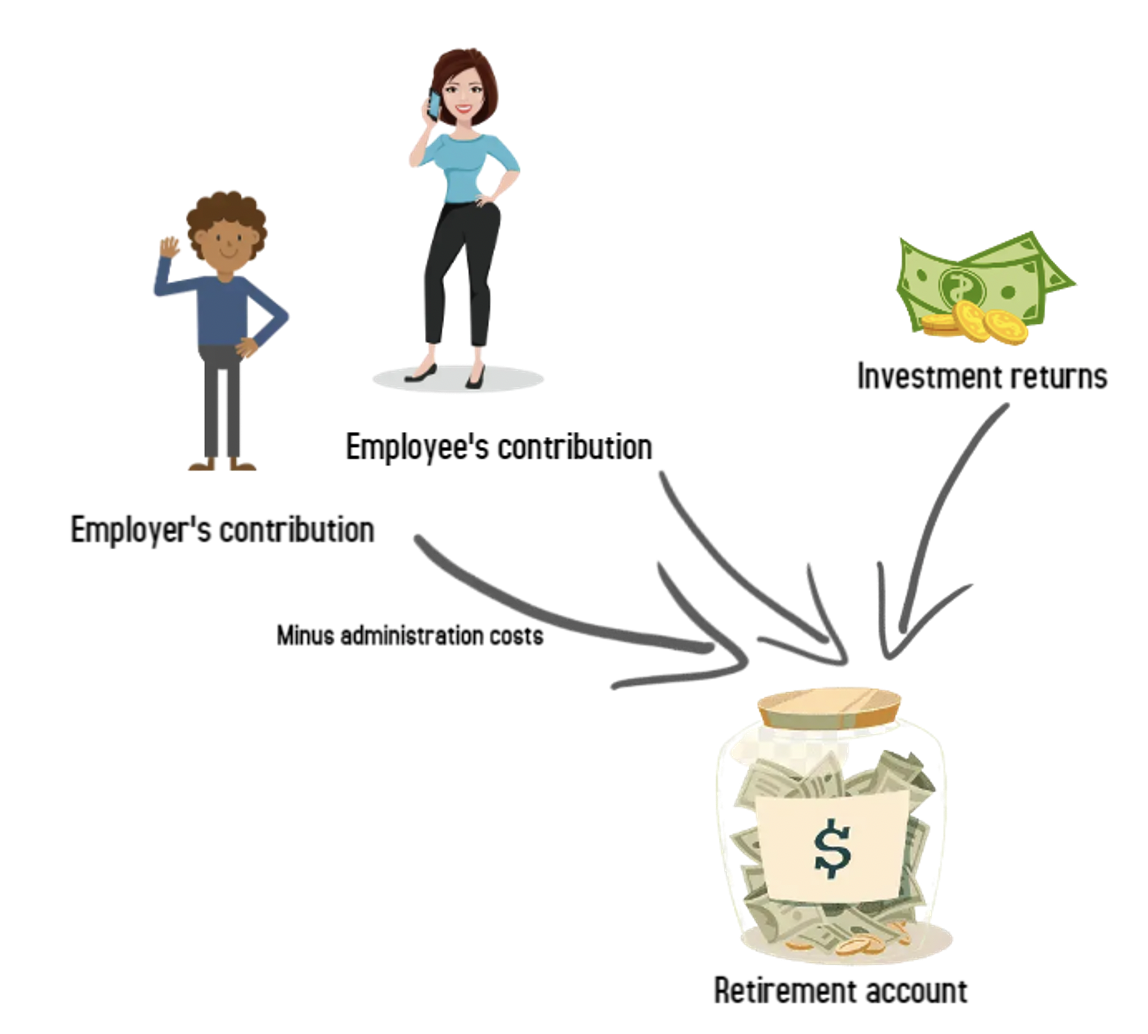

Monthly your pension contribution together with the employer’s contribution, minus the administration costs, will be booked on your pension policy.

We invest your contribution for your pension

When you start participating in de DC scheme, your net contribution is invested. The rate return on the investment, will be allocated on your pension capital. So annually your pension capital will also increase with the investment returns. The annual rate of return percentage will be evaluated each year by the Executive Board of PFTSA and depends among others on the performance of the Fund’s investments.

Purchasing a pension

On the retirement date, the accrued pension capital will be used to purchase a periodic pension benefit.

The yearly total premium contribution payable to the Fund on behalf of a participant equals:

1. a minimum of 3% of his Premium Salary payable by the participant, plus

2. a minimum of 3% of his Premium Salary payable by the employer, plus

3. an optional supplementary contribution of minimally 1%, maximally 19% of the premium salary payable by the participant and/or employer.

The defined contribution percentage payable by the participant will be withheld by the employer from the participants’ monthly salary. The monthly contributions are increased by the employer with the employers’ part of contribution. The total contribution is paid monthly to the Fund by the employer.

Any supplementary contribution for is valid for the whole year and cannot be changed during the year.

1. a minimum of 3% of his Premium Salary payable by the participant, plus

2. a minimum of 3% of his Premium Salary payable by the employer, plus

3. an optional supplementary contribution of minimally 1%, maximally 19% of the premium salary payable by the participant and/or employer.

The defined contribution percentage payable by the participant will be withheld by the employer from the participants’ monthly salary. The monthly contributions are increased by the employer with the employers’ part of contribution. The total contribution is paid monthly to the Fund by the employer.

Any supplementary contribution for is valid for the whole year and cannot be changed during the year.

The Defined Contribution plan PFTSA offers is very flexible. The participants have for example the following options:

• The participant can contribute with a higher percentage

• The participant can deposit a lumpsum (for example (part of) a bonus, (part of) the vacation allowance, etc.)

• The participant can transfer his/her accumulated pension capital from other pension fund and/or insurance company to PFTSA

• The participant can choose to retire later (not later than 70 years old)

• The participant can choose to retire earlier (not earlier than at 60 years old)

• The single participant without children younger than 21 years can choose his/her beneficiary(ies) in case the participant dies before retirement date

• The participant can contribute with a higher percentage

• The participant can deposit a lumpsum (for example (part of) a bonus, (part of) the vacation allowance, etc.)

• The participant can transfer his/her accumulated pension capital from other pension fund and/or insurance company to PFTSA

• The participant can choose to retire later (not later than 70 years old)

• The participant can choose to retire earlier (not earlier than at 60 years old)

• The single participant without children younger than 21 years can choose his/her beneficiary(ies) in case the participant dies before retirement date

Once you are not employed anymore, you will become a deferred vested participant. This means no contributions can be paid, but you still will be earning annually interest on your accrued pension capital.

A deferred vested participant is entitled to:

• Keep the accrued pension capital, earning interest, at PFTSA until retirement date

• Transfer the actuarial net reserve of his accrued Personal Pension Capital, if accrued Personal Pension Capital does not surpass 10 years in the Fund, to another pension fund or insurance company provided that those funding vehicles are recognized as such by Aruban law. The transfer of the actuarial net reserve should be direct to the other funding vehicle, without any intermediary parties involved. In connection herewith an administration fee of Afl. 250.00 will be charged.

A deferred vested participant is entitled to:

• Keep the accrued pension capital, earning interest, at PFTSA until retirement date

• Transfer the actuarial net reserve of his accrued Personal Pension Capital, if accrued Personal Pension Capital does not surpass 10 years in the Fund, to another pension fund or insurance company provided that those funding vehicles are recognized as such by Aruban law. The transfer of the actuarial net reserve should be direct to the other funding vehicle, without any intermediary parties involved. In connection herewith an administration fee of Afl. 250.00 will be charged.

If the participant dies before reaching retirement age, the partner of the participant will receive a partner pension. The amount of the partner pension depends on the accumulated pension capital of the participant. If the participant had child(ren) under 21 years or 27 years who are attending full time school and/or are disabled, they will receive an orphan’s pension until reaching the maximum age of 21 and/or 27. The amount of the orphan’s pension also depends on the accumulated pension capital of the participant.

In case the Participant dies, before reaching retirement age without leaving any children and/ or Partner as beneficiaries, 70% of the accrued capital during the period of participation may be paid out to the employer. The employer will then pay out the received sum to the beneficiary (ies) assigned by the former Participant on the beneficiary form.

The following documents are required:

• Copy of death certificate of the participant

• Copy valid ID of the beneficiary

• Copy of the bank account of the beneficiary

• Papel Afl. 5 (Censo) of the beneficiary

In case the Participant dies, before reaching retirement age without leaving any children and/ or Partner as beneficiaries, 70% of the accrued capital during the period of participation may be paid out to the employer. The employer will then pay out the received sum to the beneficiary (ies) assigned by the former Participant on the beneficiary form.

The following documents are required:

• Copy of death certificate of the participant

• Copy valid ID of the beneficiary

• Copy of the bank account of the beneficiary

• Papel Afl. 5 (Censo) of the beneficiary

3 Years after the ex-participant has emigrated, the ex-participant can request to claim the accumulated pension capital. The ex-participant will receive the accumulated pension capital, as a lumpsum. PFTSA will charge Afl. 250.00, deduct the tax wages and/or outstanding tax debts, before payout.

For this request the following documents are required:

• Copy valid ID of the participant and of the partner if married

• Original proof of deregistration of Aruba 3 years ago

• Original proof of registration in other country or Attestatie de Vita by a lawyer or an attorney.

• Original statement of Tax behavior from the Tax Authorities of Aruba not older than 3 months in the year that the payment will take place

• Identification number of Aruba on the identification card (cedula) or the Censo paper. If married this is also required for the partner.

• Copy of your personal tax number (“persoonsnummer”) in Aruba of the participant and of the partner (if married), on a letterhead/document of the Departamento di Impuesto Aruba.

• Copy of bank account on the letterhead of the bank with mention of the name and address of the bank. IBAN number and/or Swift code is required in case of foreign banks.

For this request the following documents are required:

• Copy valid ID of the participant and of the partner if married

• Original proof of deregistration of Aruba 3 years ago

• Original proof of registration in other country or Attestatie de Vita by a lawyer or an attorney.

• Original statement of Tax behavior from the Tax Authorities of Aruba not older than 3 months in the year that the payment will take place

• Identification number of Aruba on the identification card (cedula) or the Censo paper. If married this is also required for the partner.

• Copy of your personal tax number (“persoonsnummer”) in Aruba of the participant and of the partner (if married), on a letterhead/document of the Departamento di Impuesto Aruba.

• Copy of bank account on the letterhead of the bank with mention of the name and address of the bank. IBAN number and/or Swift code is required in case of foreign banks.

Once the new employee becomes a new participant in the Fund, the participant will receive a log in letter with his/her credentials to log in our Online Portal.

In the Online Portal the participant will find his/her annual Personal Benefit Statement, an overview of the booked premiums in the current year and their personal information as register at the Fund.

If the Participant needs new credentials, the participant must request this by e-mail with his/her personal e-mail address as register at the Fund, otherwise the participant can submit the request with a copy of a valid ID.

In the Online Portal the participant will find his/her annual Personal Benefit Statement, an overview of the booked premiums in the current year and their personal information as register at the Fund.

If the Participant needs new credentials, the participant must request this by e-mail with his/her personal e-mail address as register at the Fund, otherwise the participant can submit the request with a copy of a valid ID.

On an annual basis the Fund will provide the participant with a digital Personal Benefit Statement which includes, but is not limited to, a detailed overview of his:

1. name, date of birth, gender, participation date;

2. contributions paid for the year;

3. contributions paid to date;

4. accrued Personal Pension Capital to date.

1. name, date of birth, gender, participation date;

2. contributions paid for the year;

3. contributions paid to date;

4. accrued Personal Pension Capital to date.